We surveyed members of CheckoutSmart to understand their experiences of shopping during Covid-19 and their views on how their behaviour will change when things "more or less return to normal". In total 4,324 members responded, over 3,100 of whom are also online grocery shoppers.

The survey focused on how their grocery shopping experience had changed pre and during Covid-19 restrictions and their personal expectations on how their behaviour will change going forward. This blog article contains a summary of the most relevant results. More detail on specific topics may be available, please contact us to hear more.

The most significant finding is that online shopping could still grow even faster post Covid if retailers can address the two major concerns shoppers have of slot availability (which is surely just a matter of time) and the cost of delivery which must surely come down with scale and the the recent move by Amazon.

The Covid-19 Shopper survey

We surveyed members of CheckoutSmart in July 2020. The results were then compiled and summarised to existing clients who were also able to include their own questions which were reported solely to them. Shopper Insight is just one of the ways we deliver value to our clients. Here's A bit more about us:

CheckoutSmart is a Shopper Marketing Agency that uses technology to solve many of the issues faced by today's FMCG and CPG brand owners. Here are a few of the questions that we can answer:

- How do I ensure online shoppers get to see genuine online product reviews in enough numbers to maximise my sales?

- How do I get my NPD (new product) trialled by grocery shoppers in an effective way?

- How do I get feedback on my NPD quickly enough to allow me to impact my marketing communications?

- Where do I find a specific group of grocery shoppers e.g. specific product or category buyers, to gain really useful insights from?

CheckoutSmart Shopper Insight panels

As a leading digital Shopper marketing agency, we have access to a very large group of mainstream grocery shoppers. They are an ideal group to engage in surveys of this kind as we can get feedback in double quick time, allowing us to produce results in as little as 5 days. As an example, here is our survey of online shoppers talking about which categories and sub-categories they read online product ratings and reviews on.

We can also find those hard to access groups of shoppers, such as parents who are weaning children or vegans over 50, ideal for one-off brand surveys or regular insight panels. Contact us to see how we can help you make faster and better decisions.

Shoppers plan to avoid Saturday and busier times of the day

We saw that shoppers went out very early on the days that the UK Government announced the lockdowns early in the crisis. Now shoppers are saying that they will shop much less on a Saturday but there will be a corresponding rise on Sunday, Tuesday and Thursday vs how they shopped before the crisis. In other words grocery shoppers are planning on avoiding the busier days which should help flatten store demand throughout the week.

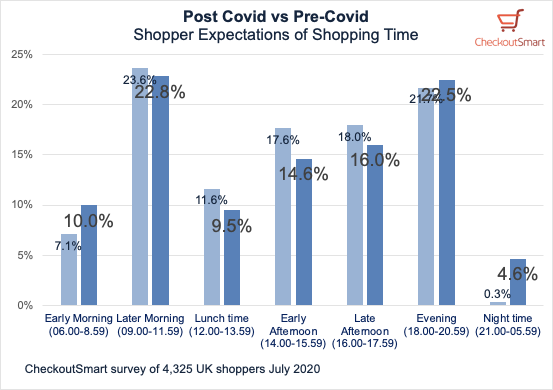

In the same way they plan to shop more at the quieter times of the day, especially late at night and very early in the morning:

Sounds like night shift staff will get a lot more to do in the future in terms of serving shoppers.

Going less frequently and spending a bit more

The other shopper habits we looked at was frequency of shop and total amount spent. The during Covid trends for fewer bigger shopping trips are set to be maintained by many. Shopping trips per week will move from 2.72 before Covid to 2.16 or minus 21%. The total spend per trip they expect to increase by just over 10%. As a result, their planned spend on grocery shopping in-store will go down by 12.6% per week. This is probably no surprise as online shopping increases and shopper reign in their grocery spending in the expected tougher times ahead. The retailers have predicted this no doubt, hence their focus on price again recently.

Why don't more shoppers, shop online for groceries?

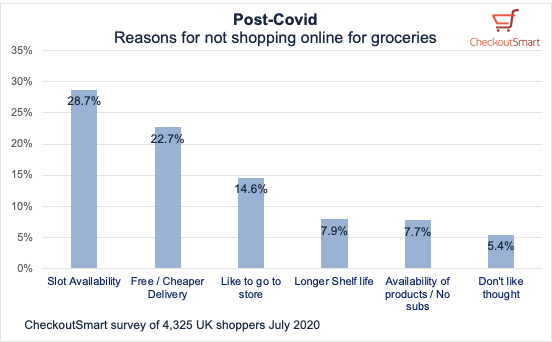

You would think in some future Post Covid world it would be easy for shoppers to imagine that they would be shopping for groceries all the time online. For some this is no doubt true, but for many this is still not. There is significant resistance to shopping regularly online with 42% of shoppers giving us reasons for not doing it regularly. The main ones being:

With the recent announcement of "free delivery" of groceries to Amazon Prime members this tackles head on the two main issues. The supermarkets may find Amazon taking a much bigger slice of the online pie as a result and could be forced to respond in like. If they do and if one does, they all probably will, then the switch to online is likely to accelerate further, not fall back post Covid.

When "things more or less return to normal"

We asked shoppers how they expect to behave when "things more or less return to normal". The first area was eating out and whether they expect to eat out more less than before. A massive 52.8% of shoppers expect to eat out less in the future than they did before, with only 9% expecting to eat out more. Good news for the supermarkets but bad news for the hospitality industry.

Shoppers plan to keep the home cooking habit and with that the healthy eating patterns they have picked up. 32.5% expect to keep their new healthy regimes with only 9.9% expecting to fall back. This feels a bit like "New Year's resolutions" all over but then they have had a few months for the habits to be created, which may sustain the new habits for longer.

Summary

There is no doubt that Covid-19 and Lockdown have had a massive enforced impact on UK supermarket shoppers. Some of the changes look like they will unwind fairly quickly as things relax like their choice of local channels, but others such as meteoric rise in online grocery shopping could be set to push on even further than may experts expect. If you sell through grocery retailers, online is certainly one to watch and critically one to not miss out on!

fans 15,785

fans 15,785

followers 4,312

followers 4,312