There is general agreement amongst members of the FMCG / CPG eCommerce community that grocery ratings and reviews are an important factor driving the rate of sale on retailer sites. However, many believe this is only when a shopper is actually doing their online shop.

Our research across nearly 3,000 regular grocery shoppers says this is not correct. These days, shoppers are looking for grocery product reviews both when they are in or near a store, at home, at work, and even walking down the street.

The key findings are:

- Online and Offline grocery shoppers regularly seek out and read product reviews. They can be at home, in-store or frankly anywhere when this happens.

- Google is the friend of the shopper seeking grocery reviews, so brand owners need to have enough good quality reviews in all relevant online stores.

- Shoppers are prompted most often to discover product reviews by seeing a product in-store, ads / social posts or when looking for a new product in a familiar category. Therefore it is critical if you are marketing to shoppers your products are supported with reviews.

- Research Online and Purchase Offline (ROPO) is a common grocery shopper behaviour but this is taking place at the fixture in an Omnichannel way. Many shoppers see a product they are curious about in the store, and their first instinct is to read the reviews wherever they find them, and then choose to buy it right away.

This research shows that grocery product ratings & reviews are used far more widely than just when shopping online and are a key driver of the purchase decisions online & in-store.

At CheckoutSmart we are always looking for more insight into how grocery shoppers use product ratings and reviews. We also acknowledge that shoppers' use of grocery reviews is not in isolation but as part of their wider usage of reviews on a whole range of goods and services.

As the only provider of 100% buyer-verified buyer product ratings & reviews delivered by our patent-pending process, we have keen to know more about what prompts shoppers to go looking for or "discover" grocery reviews.

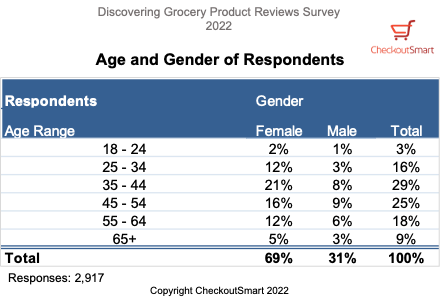

To satisfy our curiosity and to establish some clear facts about what shoppers do today, we undertook a survey of nearly 3,000 regular grocery shoppers in the UK with a broad set of demographics:

With nearly 70% of responses from women, this mirrors research that says 72% of women are mainly responsible for food shopping and cooking in the UK when in a partnership. The core age range at 25-64 years old is also a strong representation of the value of food bought in the UK, encompassing most families with children at home.

Our survey respondents are a good representation of UK grocery shopping spend.

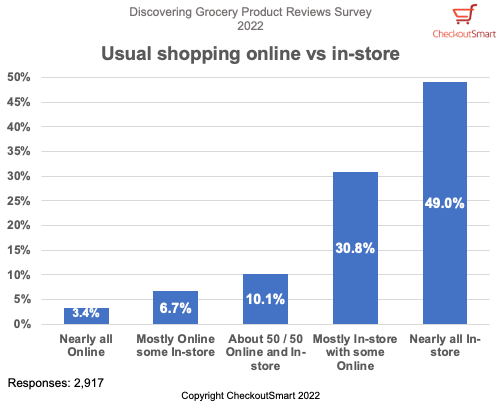

Around 51% of those surveyed choose to do at least some grocery shopping online, giving a good balance of responses to our survey and shows the growing importance of online these days within the mix of all grocery shopping.

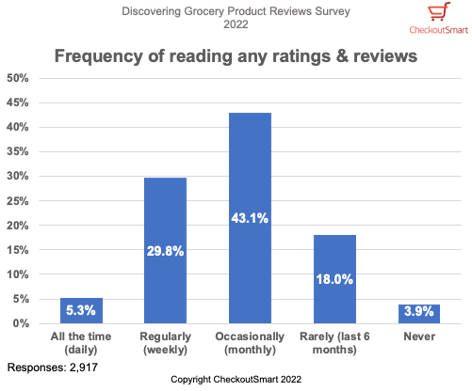

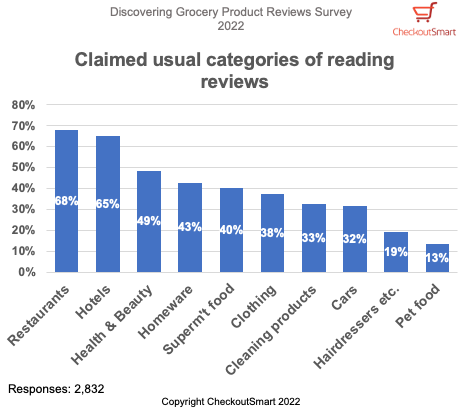

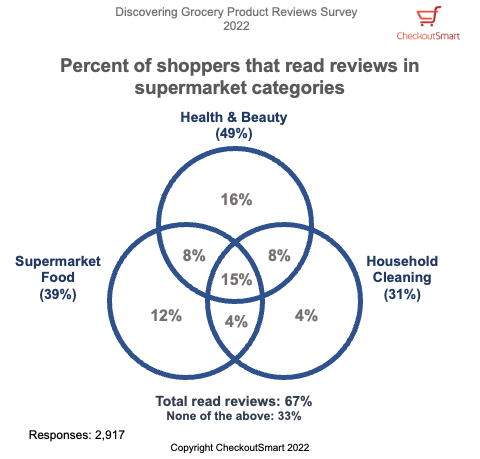

Nearly everyone reads reviews of some kind (96.1%), The most popular categories to read ratings and reviews are not surprisingly Restaurants and Hotels. However, nearly half of all shoppers regularly read reviews on Health & Beauty, two-fifths on Supermarket food and one-third on cleaning products. This is way more than just the regular online shoppers at c. 20%. This supports the view that grocery shoppers are doing their ROPO (Research Online and Purchase Off-line) on a regular basis.

We have seen in our previous research into Supermarket product reviews read by category that up to 94% of regular online shoppers read product reviews in any single category (Baby was not surprisingly top amongst households with Babies, but even Bakery was over 70%).

When we look across all shoppers in three of the main branded grocery categories (Health & Beauty, Household and Food), we see 67% read product reviews across them. Nearly half read Health & Beauty, 2 fifths for Supermarket Food and nearly a third for Household cleaning products. If we add Petfood to the equation we reach 68% but perhaps more importantly when we look at females only the figure is 74%.

The clear conclusion is that most primary supermarket shoppers seek to discover ratings & reviews across many of the main branded categories.

The next area we wanted to delve into was what prompted shoppers to look for reviews on supermarket products. To understand this we decided to split our questioning, to see if there was a difference between when they are "In or near a supermarket" and "Not in or near a supermarket".

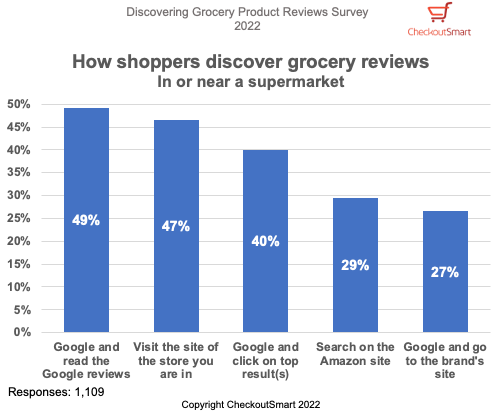

For everyone who said they looked up product reviews when they were in or near a supermarket (58%), we asked them how they went about discovering them, allowing multiple answers. Google search featured heavily as the first action, with 49% saying they read Google reviews, 47% the retailer they are in and 40% just clicking on whatever is the top result. There is a step down in numbers who look to Amazon for the answer and only 27% go to the branded site.

What is clear, is that although looking up product reviews is something shoppers do frequently, there is no single favourite way they do this (unlike perhaps Trustpilot for Hotels) and brand owners should ensure you have all the online grocery retailer sites covered (Tesco, ASDA, Sainsbury's, Morrisons, Ocado and Waitrose) plus Boots, Superdrug, Holland & Barret and even Iceland where relevant. All of these are covered by CheckoutSmart in terms of delivering 100% buyer-verified product reviews.

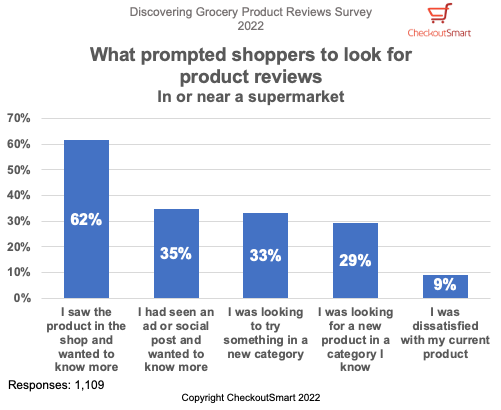

More interestingly, is what prompts a shopper in or near a supermarket to look up product reviews in the first place. The No.1 answer by nearly double was “I saw the product in the shop and wanted to know more”. This means, that if you are hoping to grow the household penetration of an existing product or NPD you had better have your reviews in order (ie with at least 30 good quality recent reviews in every retailer you are listed in - see here to find out more about the importance of reviews) or you are going to miss out on sales.

This finding refers to when shoppers are in the store, this is not ROPO, this is RI&P (Research In-store & Purchase).

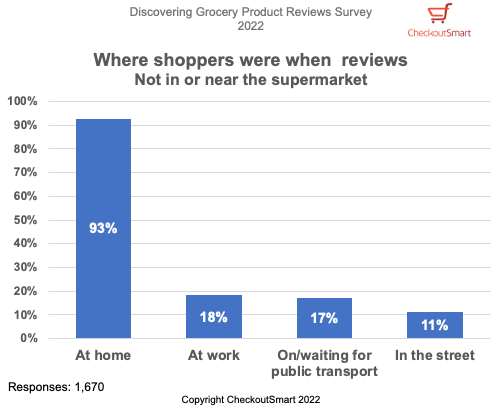

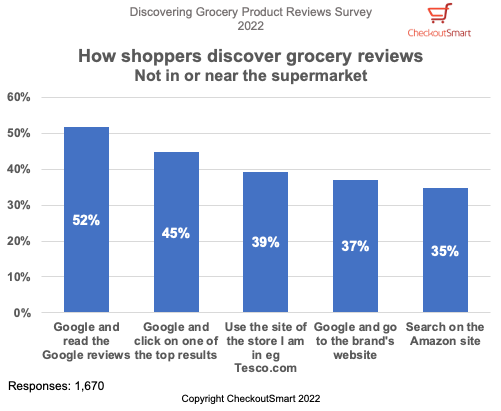

The results for when not at or near a supermarket the results are similar. Shoppers do mostly look up products at home but also on other occasions such as being at work :

There is actually a greater chance that users will Google the products for reviews when they are at home. If they are in the middle of an online grocery shop, naturally they will search there, otherwise they Google first.

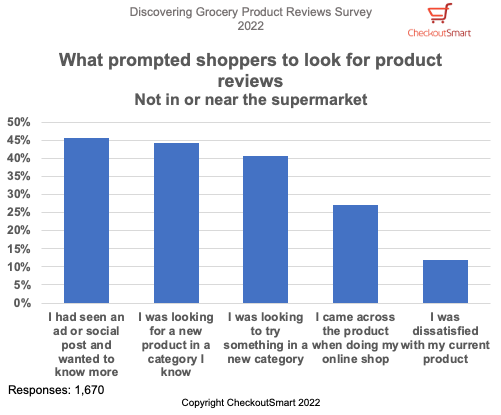

It is vital that brands recognise that all their great marketing work does lead to actions by shoppers other than simply buying the product. The omnichannel shopper journey will nearly always include an element of research whether they are newly launched or just new to the shopper in question. These are the reasons that shoppers look for ratings and reviews at home.

The research shows that FMCG marketing often triggers shoppers to do more research by looking for product reviews. Whether that is NPD or just a product that is new to the shopper, the result is the same, they look to see what other shoppers thought. If a brand does not have enough up-to-date reviews of the exact products it is advertising on traditional or social media then it will be wasting a whole lot of spend.

It is critical that if you encourage shoppers to take an interest in your products, that you have the supporting social proof from enough (>30) fresh & fair product reviews.

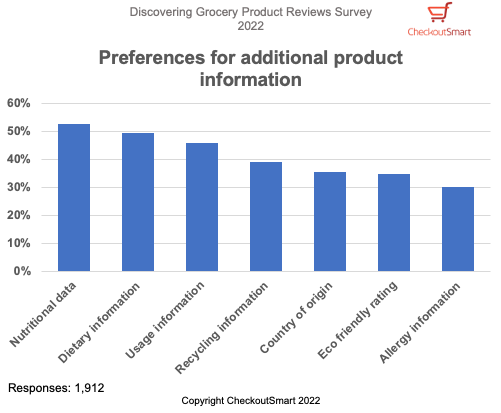

Finally, we looked at what additional information shoppers go looking for on product they are unfamiliar with. Much of this is on-pack or online but it is clear that it is demanded by shoppers and therefore continues to be part of the "basics" for e-commerce teams.

To get your own survey or access to this data set including access to the anonymous raw data is available from CheckoutSmart. Please contact us at sales@checkoutsmart.com.

To know more about how we help brands of all sizes get the genuine 100% verified purchase product reviews they deserve across retailers in the UK and beyond, please contact us:

fans 15,785

fans 15,785

followers 4,312

followers 4,312